In biotech fundraising, “value” and “price” are often used interchangeably—but they are not the same. Price is driven by supply and demand dynamics; value reflects the present value of a company’s expected future cash flows.

We offer two tailored valuation services for biotech companies:

- Pre‑Money Valuation

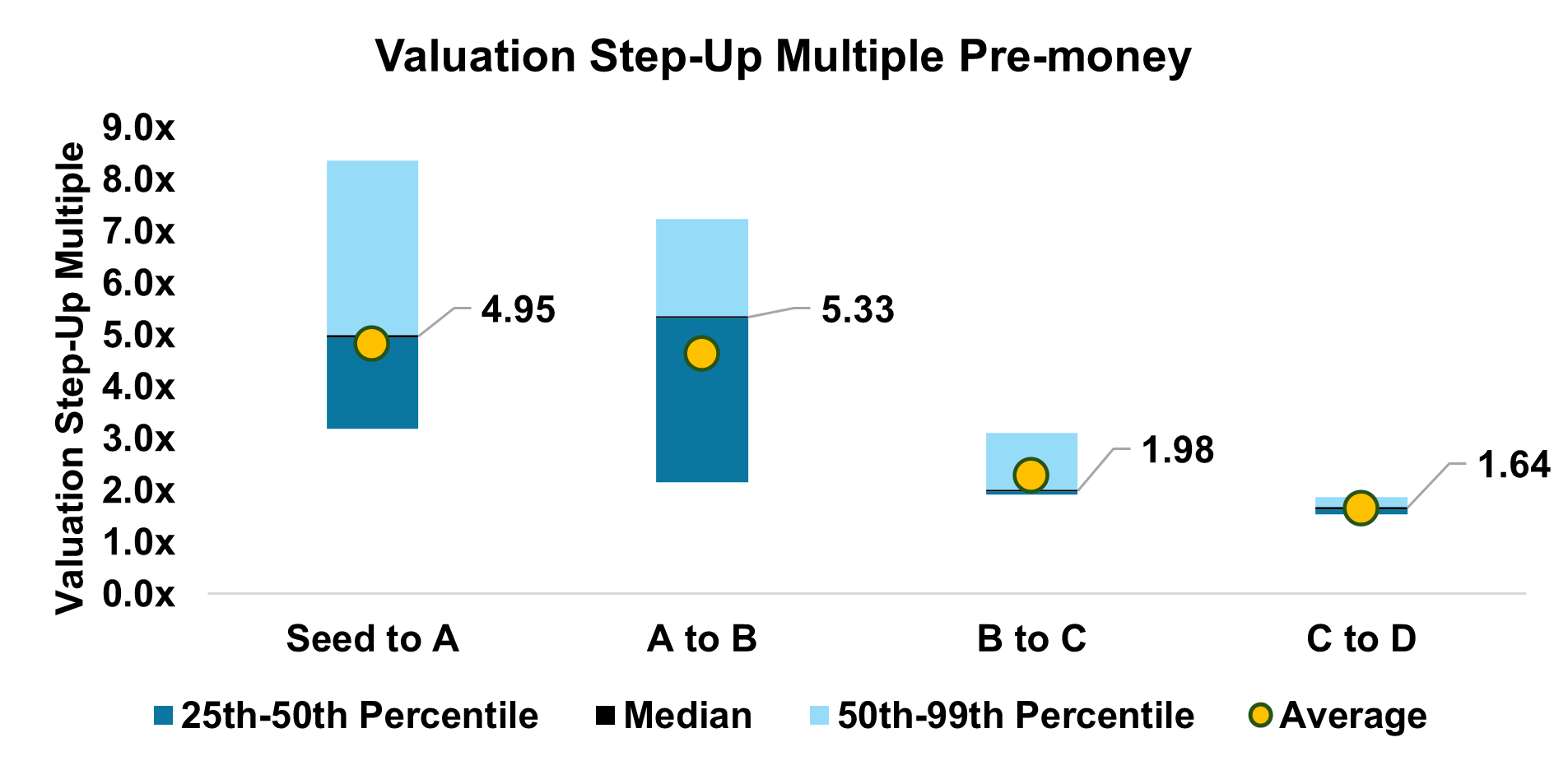

When you need to determine the per‑share price that investors should pay, we deliver a pre‑money valuation. Pre‑money valuation is not just based on the current funding round but on an assessment with the future in mind. Setting the right pre‑money valuation allows founders to manage dilution and remain appealing to VC investors while retaining the potential to maximise the company’s exit value. To follow a capital‑efficient path, we deliver a tailored pre‑money valuation based on industry standards and internal know‑how, ensuring the appropriate step‑up multiples.- Our clients have to face the following challenges when setting the pre-money valuation:

- Are you setting up a pre-money valuation that you won’t be able to back up in your next funding round?

- How much should you be raising at the current pre-money to reach the next inflection point?

- How will you deal with dilution when the Venture Capital comes?

- Our clients have to face the following challenges when setting the pre-money valuation:

- Valuation for Licensing & Acquisitions

For licensing or acquisition deals with pharmaceutical companies, we provide valuation services based on intrinsic‑value fundamentals, employing a wide range of techniques—DCF, DTA, real options, and relative valuation through comparable deals—depending on each client’s needs.

Companies create value by investing capital to generate cash flows in the future at a rate of return greater than the cost of capital. This fundamental or Intrinsic value is based on risks, growth and cash flows of the company. Put simply, anything that doesn’t increase the cash flows cannot create value.

The biggest challenge in valuing an early stage asset is how we could project the future cash flows with many uncertainties where the risks are discrete and the products could fail in any phase.

It is important to note that a good valuation is a mix of right narratives backed by numbers. The narratives also need to be test driven before it becomes a fairy tale to the audience.

Know about our interim CFO services here.